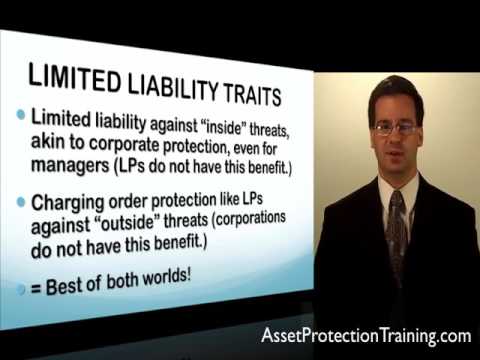

Hi, my name is Ryan Fowler and today we're going to discuss limited liability basics. So first of all, why are LLCs so popular? Well, there are a few different reasons, but one of the reasons is that you can choose, and depending on how you set it up, you can choose an LLC to be taxed one of four ways. It can be taxed like a partnership, it can act like a disregarded entity, or it can be taxed like a C or an S corporation. Now, just so you know, I'm going to explain the term "disregarded entity". A disregarded entity is an LLC or another entity set up so that its activities are treated directly as activities as if they were done by you, but only for tax purposes. For asset protection purposes, it's still a separate legal entity, but for tax purposes, you and the LLC are treated as one and the same. So, what that means is that normally, for example, an LLC cannot hold S corporation stock. But, if the LLC is a disregarded entity, it can hold S corporation stock without the S corporation becoming disqualified. Partnership, disregarded entity, and S corporation tax status - those are all what we call pass-through taxation, meaning that the members of the LLC pay taxes for the LLC instead of the LLC itself. But, you can have your LLC file form with the IRS, its form 8832, and it can be taxed like a C corporation. And then, the LLC pays its own taxes, sometimes at a lower tax rate that you would normally pay, and only when distributions are made to you would you pay an extra tax. Sometimes people don't like the C corporation tax treatment because you would be paying taxes twice - once when the...

Award-winning PDF software

1122 and disregarded entity Form: What You Should Know

Ticket items should include the following: (1) Goals such as those outlined in the Scout Handbook, such as supporting Diversity, and fostering tolerance. (2) Examples of activities that promote diversity. (3) Possible activities or projects supported by the award. (4) Possible ways to share and/or discuss this award with your membership or troop. (5) The best time to introduce this award is at your upcoming or next Board meeting or in person. What kind of ticket items do you recommend for your BSA leaders? — What kind of activity should a Wood Badge Ticket Support? — Activities that promote diversity, such as: What kind of items should be included in a BSA Wood Badge Ticket Diversity Item? — What other issues would you like to know about? Please leave any questions you may have in the comments section. We will try to address them. Thank you for your help, and we would like to hear from you.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 851, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 851 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 851 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 851 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Form 1122 and disregarded entity