Award-winning PDF software

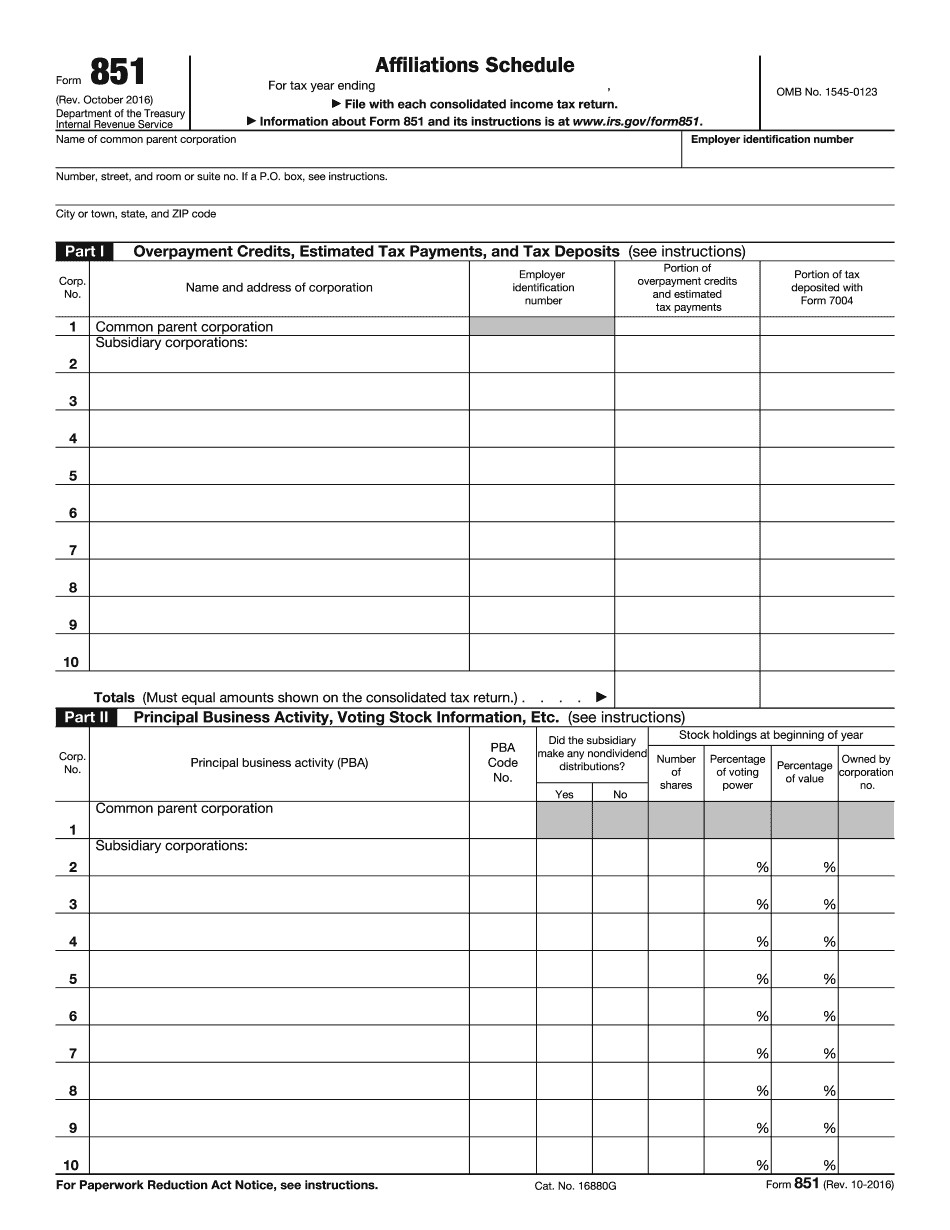

form 851 (rev. october 2016) - internal revenue service

Use Form 851 to report estimated tax payments. ▷ Use Form 852 to report the amount of income that is subject to an itemized deduction for the taxable year. ▷ Using the standard deduction is advisable for taxpayers with low income. ▷ If you do not have to file Form 852, file Form with all payments you make this year. ▷ You can calculate the interest cost in part of a loan on Form 1042, Income Tax Return for the Year Ended December 31, 2016, or in part on Form 2201, Income Tax Return for the Year Ended December 31, 2015. ▷ If you owe taxes, and you owe interest on a loan, report on Form 1040, Individual Income Tax Return. ▷ You can use Form 1040‑SF to report the tax consequences of an overpayment on Form 1040, Individual Income Tax Return. ▷ Use Form 1040‑PA,.

About form 851, affiliations schedule | internal revenue service

Filing the 990s with Schedule E Under sections 904 and 905(b) of the Code, you must file a 990-EZ by either Form 990 or Form 990-PF, if necessary. For Form 990-EZ reports, you must file by April 15. For Form 990-PF reports, you must file by October 15. Forms filed earlier than April 15 may not be accepted for filing in future years. See the Instructions for Forms 990-EZ and 990-PF for additional information. File Form 990-EZ You generally should file Form 990-EZ by April 15. You may want to wait until you receive the information you need from Form 990-PF to file a 990-EZ. If you are an entity reporting on more than one balance sheet during the year, this rule does not apply. If you know that the information you need from Form 990-EZ may be different from the information that is shown on your income tax return for the.

instructions

The corporation also files Form 852 for itself and its shareholders (in which case it must provide all the information required in the original Form. 851). Form 852 must contain information for each shareholder of record of the corporation. The information must be the corporation's taxpayer identification number, and the shareholder's identification number on Schedule O. Form 852 provides all the information for the shareholder, not just the shareholder's identification number on Schedule O. For each shareholder of record, complete the “Statement of Distribution to,” and fill in columns 1, 2, and 3. Each shareholder of record need only complete one column. The column “Shareholder's identification number” should be blank. Use a special form of check to print the number if it is missing or inaccurate. If the number is missing, you can fill in the blank with the shareholder's social security number or similar information, or fill in the column.

corporate income/franchise tax affiliations schedule attach this

This form must be filed by the following taxpayers: All corporations. If the Form F-851 is not filed, tax on the corporation's return will be withheld, the corporation will be subject to a tax at the same rate as the taxable income paid to the individual officers and shareholders. The corporation must have one or more of the following shareholders named as the officers and owners within the previous year. The form must be filed with the tax return for the taxable year. An individual who resides in this State at the end of the calendar year. A qualified Florida corporation that qualifies to file a New Mexico Form of Return. A New Mexico resident, either in this state or who holds a qualifying address outside this state. All other taxpayers. If the Form F-851 is not filed, tax on the corporation's return will be withheld, the corporation will be subject to a tax at the.

form 851 "affiliations schedule" - templateroller

To make the process less cumbersome, Form 851 can also be used as a substitute for filing a Form 1040. In this example, Form 851 should be filed electronically on line 23 of your tax return. What's in the box: Form 851 is filed electronically once you have identified the child(men) to whom you are claiming child and dependent exemptions. The amount of child and dependent exemptions for each child may be listed on Form 851, Form 851-EZ, or other separate forms. This box reports the amount of tax claimed for the year by the taxpayer and the total amount of income taxes claimed for the year. For example, the taxpayer filed a joint return for 2009 from the same address. The child(men) claimed only one exemption on their 2009 return, with the taxpayer reporting all the income. The child(men) claimed the same amount on their 2010 return, with the taxpayer reporting.