Award-winning PDF software

Form 851 Corona California: What You Should Know

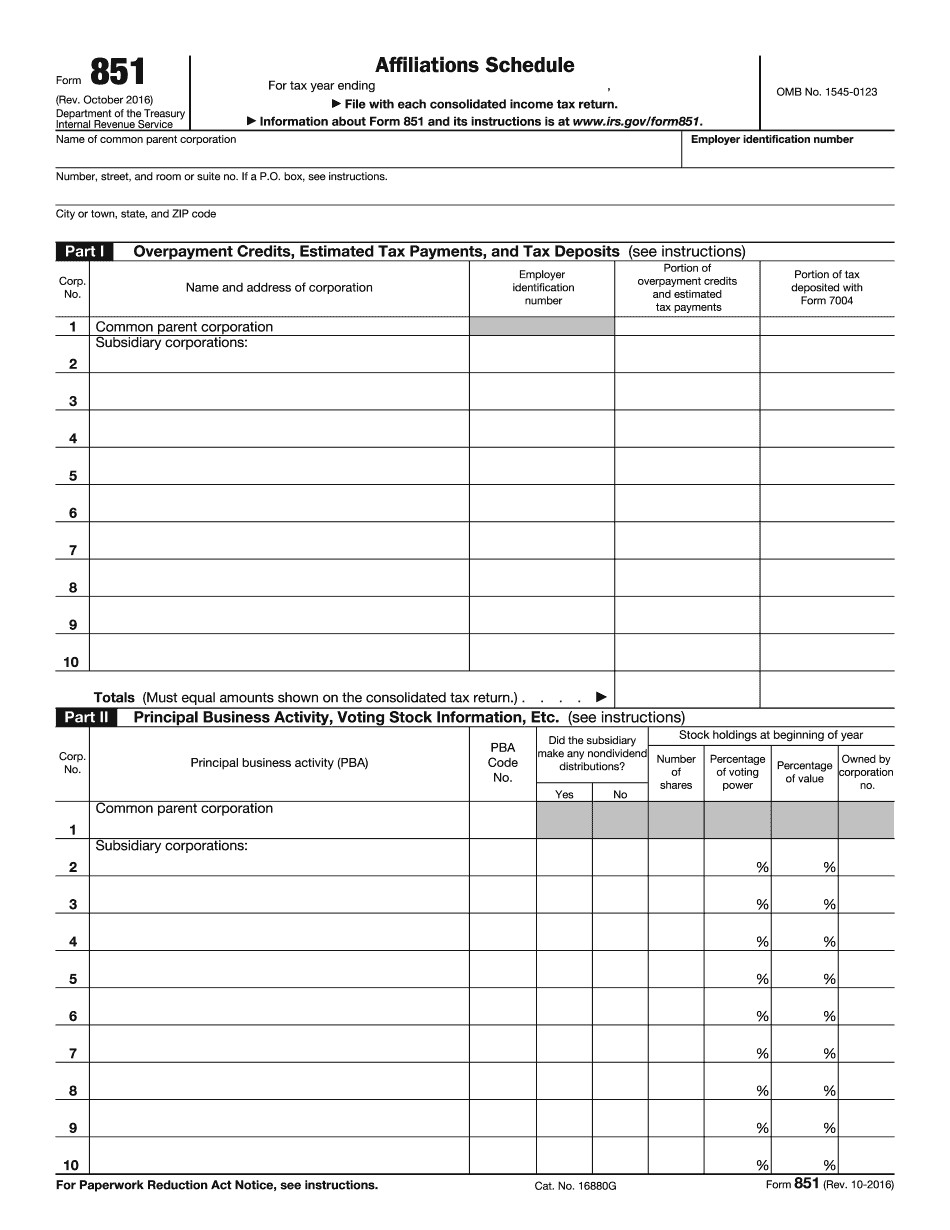

Form 851 need to be filed by the same day? No; Form 851 is just an additional document to a consolidated return. It's a supplemental return to an individual return and doesn't need to be filed in the same calendar year. What does Form 851 cover? Form 851 provides an entity information report, or affiliate information report. The affiliate information report includes reports for corporate officers (or directors), corporate secretaries, directors, members, directors' spouses and members' spouses. The affiliate information report is due on Form 990-NR within 60 days from the month the return was filed. Why does the parent corporation need to file Form 851? Form 851 is a reporting requirement for all corporations in a consolidated return. If a corporation fails to file Form 851 for two years, the corporation may be subject to penalty and assessment of interest. In addition, Form 851 may be filed each year by the affiliated entities with which the parent corporation has an agreement for dealing with consolidated returns. A list of entities that have agreements for dealing with consolidated returns can be found in the section “Corporate Subsidiaries” of the Form 990-NR. When is Form 851 due? Form 851 must be filed by March 15th for the taxable year in which it is required (or the year the corporation expects the return to be filed). If Form 851 is not filed by the required month (i.e., March 15th), the return is due in July, but must be filed by January 31st. Why is Form 851 necessary for the parent corporation? If the corporation is in bankruptcy, bankruptcy trustees could order the corporation to pay interest on the delinquent balance of the return in addition to penalties and interest. That interest may exceed the amount of any penalties and interest that the corporation is already paying, and may also impose a penalty on the corporation's future annual returns. Where do the affiliates' names and addresses show up on the Form 851? The affiliates' names in the Form 851 are reported in the same place on the consolidated return as their name, address, and TIN (if applicable). Why did the IRS delay the effective date of Form 851 until January 1, 2017? In the case of Section 746, for a corporation's first report, the effective date of Form 851 is January 1, 2017. Can my affiliate substitute a corporation for itself (Form 851-B)? Yes.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 851 Corona California, keep away from glitches and furnish it inside a timely method:

How to complete a Form 851 Corona California?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 851 Corona California aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 851 Corona California from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.