Award-winning PDF software

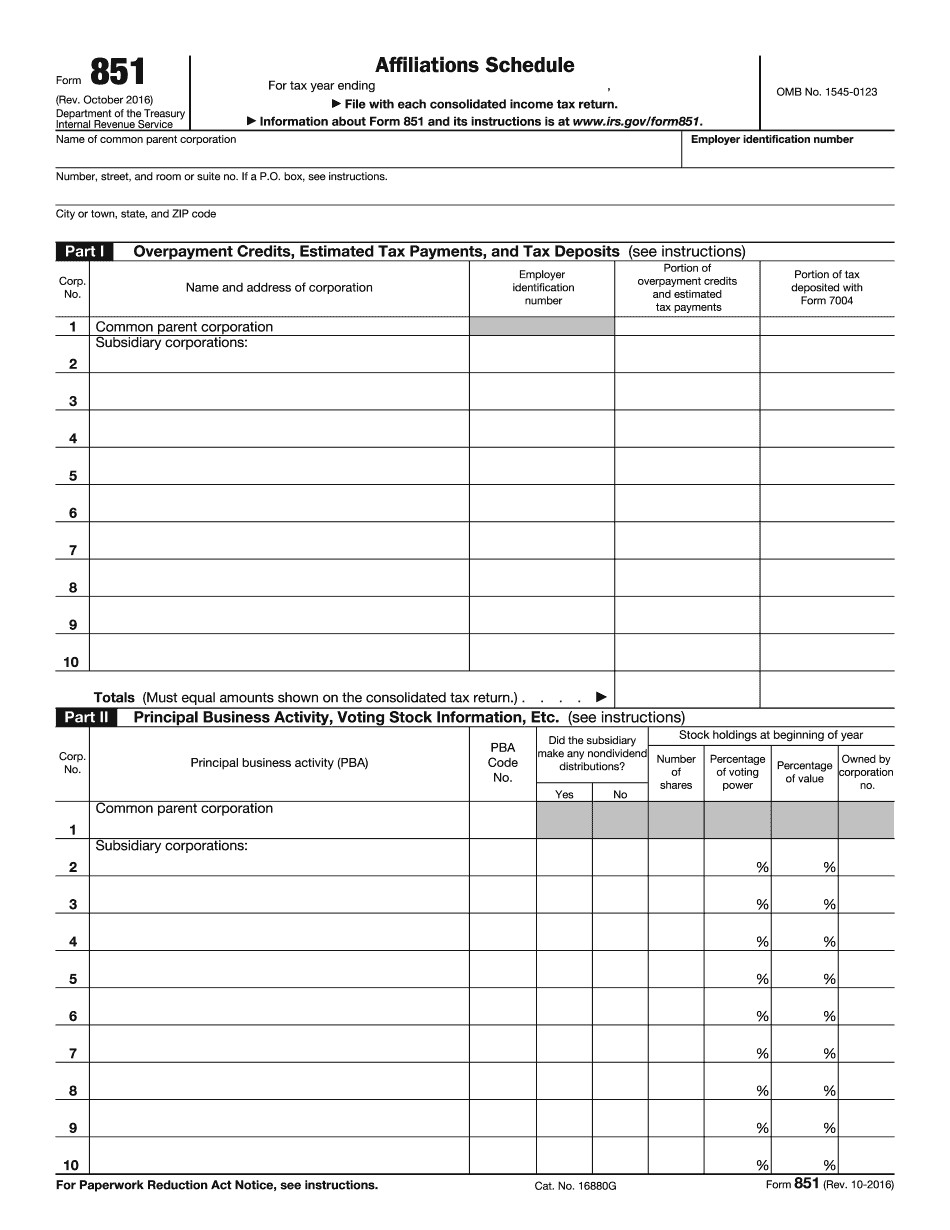

Printable Form 851 Las Cruces New Mexico: What You Should Know

An original copy should be mailed to the New Mexico Department of Revenue at the address to above. New Mexico resident taxpayers filing a joint return must complete the individual returns for all partners. The tax payable on Schedule C is divided between partners jointly and separately with the spouse, regardless of their share of partnership income and, for the spouse, regardless of whether the partner's share of partnership income results in joint or separate tax. This means that all partners must file a joint return if the amount of tax payable on the return is more than 5,000, otherwise partners must file separately for each partner's individual tax liability. However, spouses filing a joint return cannot be each individually liable for more than 100 in tax under the provisions of New Mexico civil law (see New Mexico Rev. Stat. Sec. 4021, 4023 and 4022). A filing is considered correct if all items and amounts on the return for each individual are accurate and complete. There should be no errors or omission due to any failure of the taxpayer to keep the records required under this statute. If you have any questions or need additional documentation related to your return, contact the Taxpayer Assistance Program by calling. Forms : Businesses Business Tax Forms : Individuals Business Income Tax Return. New Jersey and New York, use Form 8379. If you are a New Jersey resident and New York resident and want to see how your tax liability is calculated under the income tax provisions of the State of New Jersey, use the form below. If you are a New York resident and want your income tax liability calculated under the State of New York income tax provisions, use the form below. If you are a New Jersey resident and a resident of New York State and want to see how your tax liability is calculated under the income tax provisions of the State of New York, use Form 1099-X. Any form submitted must meet the following two requirements. First, it must show the business or trade name, address, employee contact information and taxpayer identification number. Second, it must include the gross income for the period, but do not include interest, dividends or other forms of exempt income such as pension income, capital gain, etc. Forms : Businesses Forms : Individuals Individual Income Tax Return. New Mexico and New York use Form 8379.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Printable Form 851 Las Cruces New Mexico, keep away from glitches and furnish it inside a timely method:

How to complete a Printable Form 851 Las Cruces New Mexico?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Printable Form 851 Las Cruces New Mexico aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Printable Form 851 Las Cruces New Mexico from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.