Award-winning PDF software

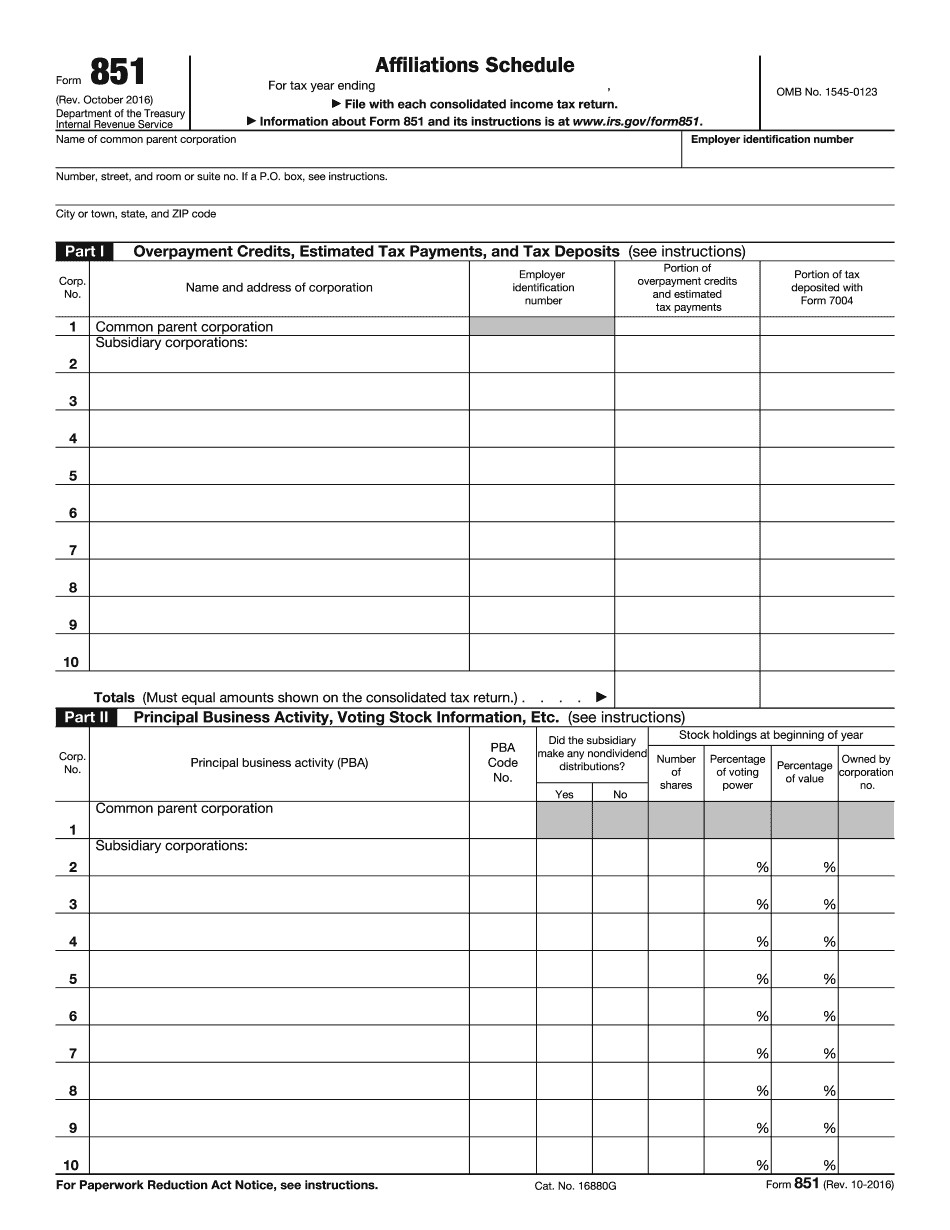

MI Form 851: What You Should Know

Finance Department, City of Berkeley has decided to not charge businesses/cities a tax on certain non-business deductions. The reason for this change is to preserve the state's ability to enforce tax collections for non-business purposes. City of Berkeley Tax Department This guide will help you locate the information that will guide the determination of your tax liability, including items for which the city may choose not to collect. It will help to ensure the correct amount of tax is declared on your tax return by the deadline of your return. You should also review the current tax liability of your business by using the Taxation Center. To access the Taxation Center, click on the blue Taxation Center icon in the navigation panel. On the left panel in the Taxation Center, click on Forms, Schedules, and Info. From the right panel, enter in your address, company name, business type, year & period, and the total amount that will be tax, and you will receive a listing of the forms, schedules, and information that you need to complete for complete information. For more help in determining your tax liability, view the Taxation Center online. To open the Taxation Center, click on the “T” icon in the navigation panel. On the left panel in the Taxation Center, enter your address, company name, business type, year & period, the total amount that will be taxed, and you'll be able to see the information for your tax return. For more tax tips, tips are located at Mar 20, 2016 Form 6166 — Taxable Event Not Resulting in a Personal Benefit This form will be used as evidence in cases where the individual's decision to attend an event is considered to be primarily related to his or her business. The purpose of this form is to support a determination that a taxable event, such as a meeting, social function, or other similar activity, was not conducted primarily in order to make a personal benefit as opposed to profit to the participant. The Department of Taxation must find, after due investigation and review, that any taxable event that was not not made with a business purpose is to be considered as not having a business purpose only if it meets the following criteria: A taxpayer meets these criteria if the taxable event was not conducted primarily for personal benefit.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete MI Form 851, keep away from glitches and furnish it inside a timely method:

How to complete a MI Form 851?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your MI Form 851 aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your MI Form 851 from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.